Failures are part of life. It is a sign that you are trying to do something to succeed. The only ones who never fail are the ones who never try. In trading, it is impossible to win at all trades. Going wrong in your analysis or execution is part of the game.

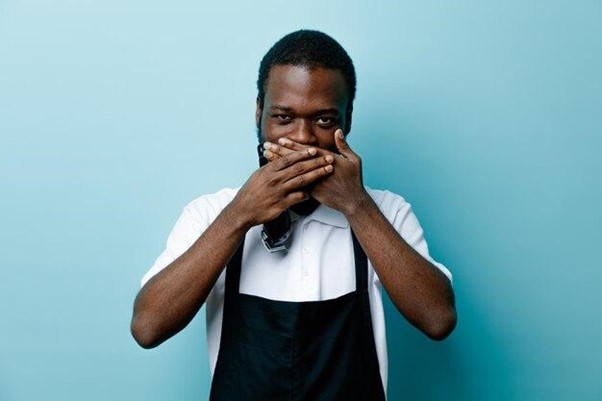

But it is not those mistakes, but rather how you respond to such mistakes that help you transform them into stepping stones of success. You can handle your failures well if you avoid these three mistakes – worrying, lamenting, and retaliating. The three-fold approach would be to:

- Withdraw from your temptation to retaliate

- Back off from constant pondering over the result

- Refrain from making any adverse remark about the trade

Withdraw from your temptation to retaliate

Here retaliation refers to thoughts like “I’ll recoup my losses today itself” or “Aha, so I’ll show you how I can make a profit” and the like. Trading is not a field where you can retaliate or seek revenge; there should be a complete absence of any sense of vengeance. Why? One, because the very thought of retaliation stems from unfavorable or self-defeating emotions, and trading is a field that reserves absolutely no place for any kind of emotions. Two, because retaliation, vengeance, etc. come to play only when someone intentionally does anything against your well-being. Here, the loss you suffered is not curated by someone else. You are the sole person responsible for the loss you suffered. Your analysis might have gone wrong, your impulsivity might have played spoilsport – it could be anything like that. So what is the whole point in feeling revengeful?

The ideal solution when such thoughts spring up in your mind is to reorient yourself. Take a step back, acknowledge your mistake, take responsibility, find newer possibilities, and prepare well for the next trade. Do not allow your impulsivity to take the next trade very quickly, in an attempt to cover the loss from your lost trade.

Back off from constant pondering over the result

Pondering about the incident will create a habitual tendency in your mind to think about unpleasant things. It also creates and reinforces unfavorable emotions in your mind. These emotions will stand in the way of the proper execution of your skills and knowledge.

Moreover, constant pondering will set up a vicious cycle where it repeats over and over. Your thoughts about your failure will prompt you to do something unfavorable that will mar your progress in your journey towards trading excellence. Thus, you will be trapped in that vicious circle of poor performance, constant pondering, unfavorable emotion, and poor performance.

Making oneself aware of the adverse side effects of constant remembrance of failure is the only way to come out or prevent yourself from entering this vicious loop.

Refrain from making any adverse remark about the trade

When faced with a defeat, people often make passing remarks like, “Don’t ever trust Gold, it is very tricky” or “That pair ripped me off.” Such comments do not go away without causing you even more worry. Every word you speak is getting registered in your brain, in your mind. And it has a significant role in designing your future thought process and thus deciding your future behavior. So if you do not want the same situation to happen again in the future, refrain from making any adverse remarks to anyone about the incident. Stop lamenting about your loss. It is not going to improve your situation even by one degree. Instead, spend your time exploring ways to protect or guard yourself against failures. The only benefit you give from making adverse remarks and lamenting is a temporary psychological satisfaction or relief from the frustration you feel in your mind. And that is a very mean way of relieving your frustration. A better alternative is to change the circumstance that led you to such a temporary defeat.

Start bringing in these three attributes to your trading life. It may seem difficult at present, but with a concerted effort, in due course, you will be able to master all three of them. Once you master them, then you will be surprised to note that adverse results no more affect you in any way – in thoughts, speech, or action. That is the state you should aim for, and that is 100% achievable through focused practice. It would also do good to seek professional advice on how to implement this in your trading life. A professional mentor can help you identify where you are going wrong, how to change your thought process, and how to implement this strategy in a step-by-step manner so as to apply it effectively in your trading journey.

The goal is not to reach a state of no failure, but to reach a state where failure does not affect your emotional balance, does not cloud your intellect, and does not affect your motivation.